Helping lenders gain efficiencies, reduce risk and increase ROI

Trusted for more than 35 years, AllRegs® by ICE Mortgage Technology® is the leading source for agency guidelines, state and federal compliance regulations and correspondent investor information. Quickly and easily find the content you need to stay up-to-date and manage risk. Encompass® customers have the added benefit of accessing AllRegs directly from the loan origination workflow.

Increase efficiencies and improve loan quality throughout the loan lifecycle

AllRegs®’ trusted industry resources are available to help you increase effectiveness, adhere to compliance regulations, and generate high-quality loans — all contributing to an improved ROI.

Better loan quality

With AllRegs, you can confidently navigate ever-changing agency guidelines, underwriting requirements, compliance regulations, and investor information. The various AllRegs package options give lenders easy and important access to current information for:

Single-Family Lending Package

A comprehensive online database consisting of thousands of government and conventional single-family lending guidelines and forms. Accurately maintained and easily accessible with a variety of easy-to-use features, you’re assured of fast, reliable answers as well as the right forms when you need them.

Benefits:

- Thousands of pages of government and conventional single-family lending guidelines and forms

- Proprietary tools to access information quickly

- Embedded links to the most current information and hard-to-find documents

- Pending legislation

- Federal disclosures and other forms

- Quick answer search for your home state compliance analysis and commentary

- A single, reliable source for all the things you need to know, but shouldn’t have to remember

- Seamlessly integrated with Encompass®

State Compliance Package

Remove risk without having to add members to your team or hours to your day. Quickly locate current, state-specific information and requirements for licenses, education, fees and more. Originators, closers, servicers, and compliance officers simply target the state they want and get the pertinent information delivered to their fingertips.

Benefits:

- Dynamically generate reports that compare information across states and export it into useful file formats

- Easily export multi-state compliance matrices for further annotation or changes

- Save the report criteria to be re-run at a later time with updated information

- Link back to the authoritative laws and regulations in AllRegs®

- Get a condensed analysis of information across a broad range of compliance topics

- Research multiple states at once to save time managing compliance

Multi-Family Lending Package

The Multi-Family Lending Package is a collection of underwriting and insuring guidelines, consolidating all the multifamily information you need into one convenient, reasonably priced package. It delivers cover-to-cover guidelines with forms and exhibits for Freddie Mac and FHA. It also includes relevant sections of the Code of Federal Regulations and Federal Register.

Benefits:

- Proprietary tools to get you to the information you need fast, backed up by years of user feedback

- Embedded links that bring you from obsolete documents to the very latest information

- A single, reliable source for all the things you need to know, but shouldn’t have to remember

Mortgage Mentor Guides

Give your originators the tools to navigate critical CFPB expectations and originate compliant FHA and VA loans with confidence. AllRegs® Mortgage Mentor Guides are up-to-date, online instruction manuals that leverage the AllRegs® search engine to provide your users with reliable answers and industry-recognized best practices for success.

Benefits:

- Links to supporting federal publications and announcements

- Step-by-step guidance for ensuring compliance

- Exclusive worksheets and checklists designed with the novice user in mind

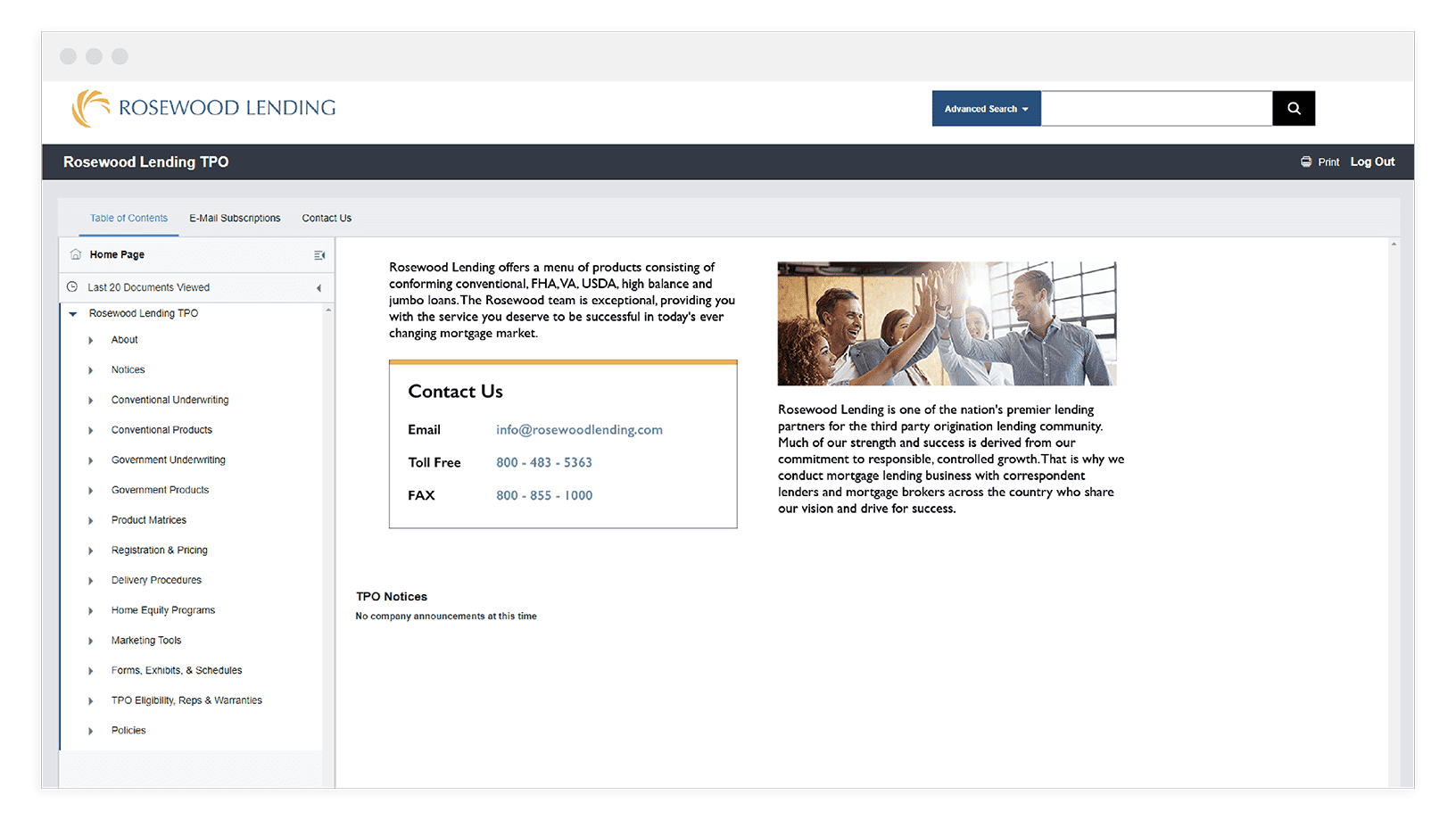

Publishing Services

Change happens fast and out-of-date content can confuse customers and employees, and wreak havoc on closing times and compliance. AllRegs® Publishing Services ensures your employees, business partners and customers always work from content that keeps them compliant and efficient.

Learn about our Publishing Services

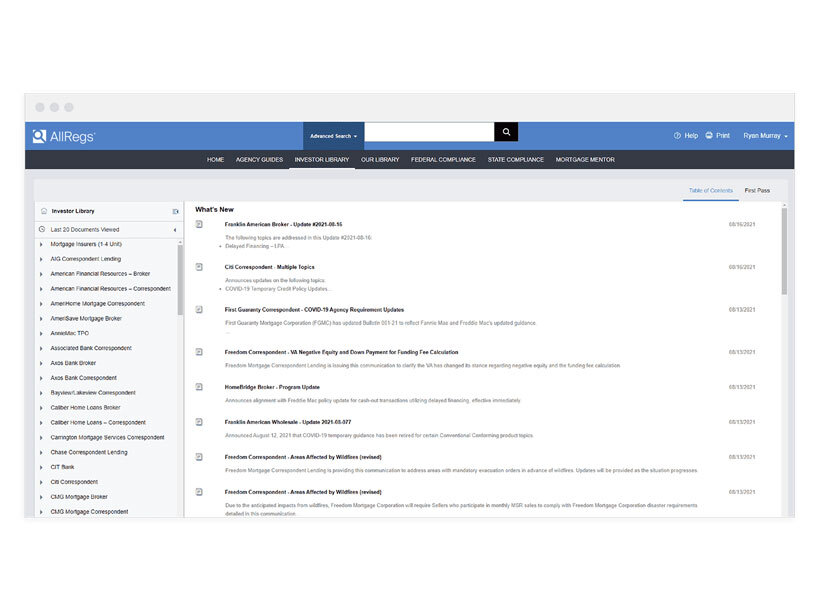

Investor Library

Access full narrative guidelines on key industry investors all inside of AllRegs® - your single, reliable source of truth. Accompanied by the Single-Family Lending product, this allows you to access all of your investor guidelines in the same location as your single-family lending guidelines and compliance content. With the AllRegs® Investor Library, you can view product guidelines for participating investors that you are currently doing business with, as well as investors who have opted to share their product guidelines on an open distribution basis.

See all the investors in the library

Policy and Procedure Guides

Take the labor out of creating and maintaining policy manuals from scratch. Explore our extensive catalog of prewritten policy and procedure guides, built to give you a jumpstart. Our guides are customizable to meet your regulatory and internal compliance requirements.

Download the datasheetProduct summaries and purchase options

Contact sales

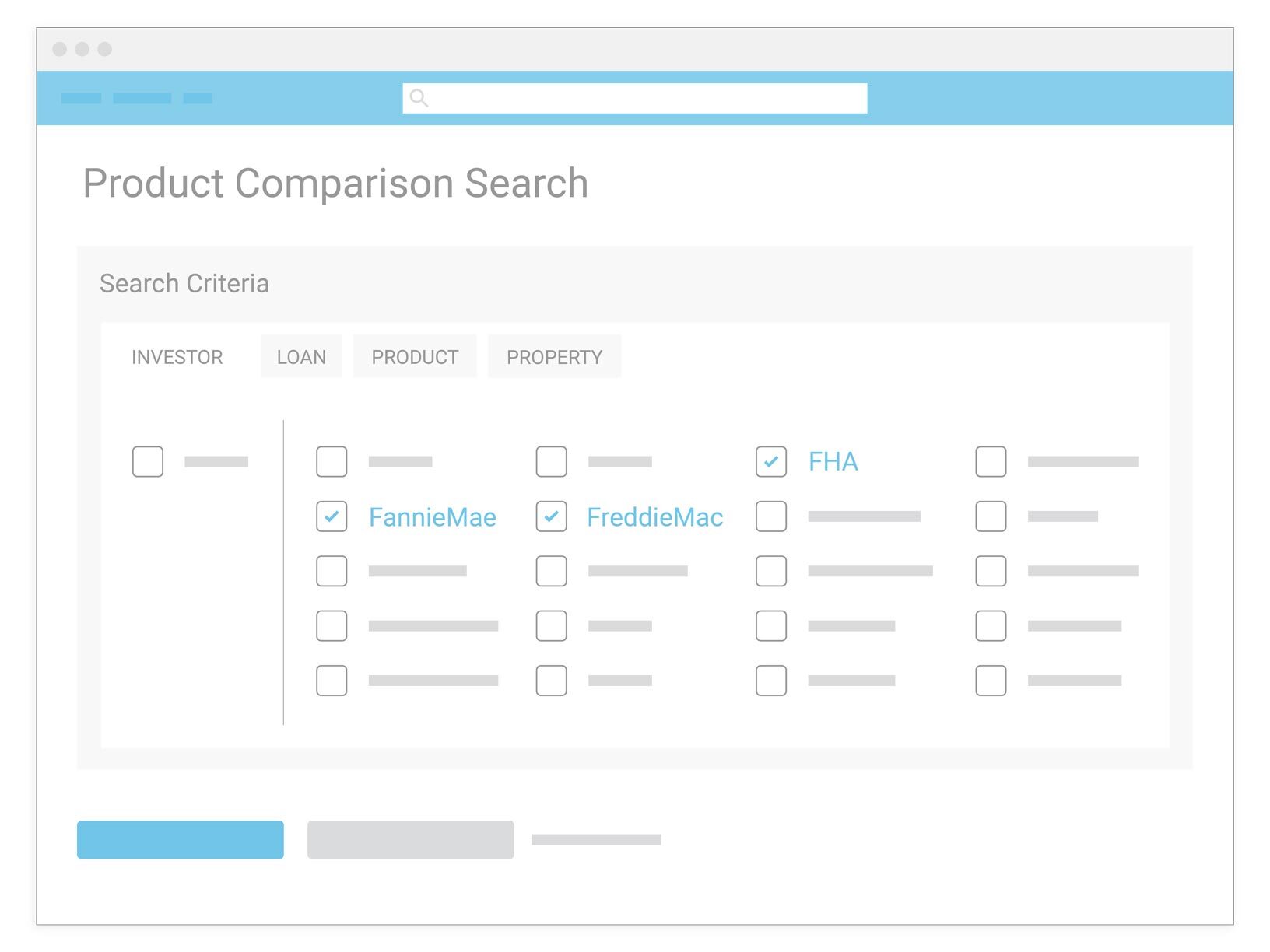

Market Clarity gives you the ability to compare and contrast more than 3,000 loan products from 95 different investors. Identify opportunity with a searchable solution that compares up-to-date product, investor and overlay information.

Read the datasheetSee all the investors in the library

Resources

Learn more about how ICE Mortgage Technology® is changing the industry and stay up-to-date with the latest tools and information.

See all resources